IC Markets is one of the reputable Forex trading support brokers loved by many traders, attracting a large number of investors. When it comes to ICMarket, the majority of traders give this trading platform a very good rating and this is also a trading platform with a high score in all aspects. To know if IC Markets is a reputable broker for you to choose? Let’s learn and evaluate this platform with TraderForex.

ICMarkets Overview

IC Markets is an ECN trading platform founded in 2007 in Sydney, Australia, founded by a group of innovative financial experts. With more than 15 years of operation, this exchange has built a solid position in the investment community in Vietnam and around the world. The exchange also received operating licenses from reputable organizations such as FSA, ASIC, CYSEC and SCB.

ICMarkets’ main goal is to develop into the world’s leading Forex CFD trading platform. To achieve this goal, they always strive to bring the best experience to customers. The exchange offers the top three trading platforms, MT4, MT5 and cTrader, with extremely fast order execution speeds of less than 40 milliseconds. Over 2000 trading instruments supported and competitive spreads from as little as 0.0 pips.

Until August 2022, IC Markets has achieved many remarkable achievements with impressive numbers:

- 180,000+ trading customers from everywhere

- Trading volume exceeded 1.11 billion USD.

- 500,000+ transactions are made every day.

With such outstanding results, ICMarkets has become the forex trading exchange with the largest trading volume and in the top of the exchanges with the lowest spreads today. With 15 years of operation experience, this will definitely be the perfect choice for investors.

| Founded year | 2007 |

| Management agency | FSA, CySEC, ASIC, SCB |

| Exchanges | ECN |

| Minimum deposit | 200$ |

| Spread | Từ 0.0 pip |

| Trading platform | MT4, MT5, cTrader |

| Support language | Tiếng Anh, Tiếng Việt |

| Deposit – withdraw money |

|

Is IC Markets really a reputable exchange?

An important issue that investors are always interested in when considering ICMarkets or any other exchange, is about credibility. To have an objective view of whether the IC exchange is reliable or not, let’s evaluate the following information to have the most objective view.

Operating time

Since its founding in 2007, ICMarkets has been in the financial investment market for about 15 years. This is quite a long and valuable time for the trading market. During this time, the exchange has shown its responsibility to ensure the interests of customers and there is no information related to IC Markets fraud.

However, looking at it more objectively, in fact, there are still some articles on social networks about this trading platform with content such as: “ICMarkets scammed, appropriated 1.1 billion and only returned it back. for traders 412 million.” However, there is no concrete evidence to verify these claims.

License to operate

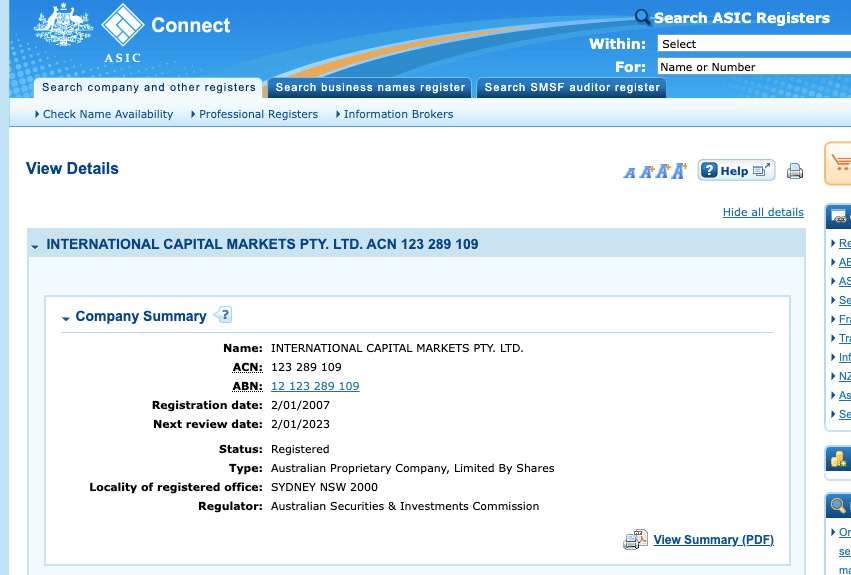

The fact that IC Markets holds numerous licenses from prestigious international financial institutions and organizations is proof of its legitimacy, including:

- Seychelles Financial Services Authority (FSA): This is the regulatory, supervisory and development agency for non-banking financial services in the Seychelles. Obtaining a license from this organization is very important for exchanges, ensuring absolute credibility, and the platform has been granted operating license number SD018.

- Australian Securities and Investments Commission (ASIC): This committee is the leader in the regulation and supervision of financial activity in Australia. ASIC license number 335692 has been issued to the exchange.

- Cyprus Securities and Exchange Commission (CYSEC): This is a financial regulatory body in the Republic of Cyprus, responsible for protecting the interests of investors and promoting the transparent development of financial markets. . IC Markets has received license number 362/18 from CYSEC.

- Securities Commission of the Bahamas (SCB): ICMarkets has also been granted license number SIA-F214.

With strict supervision and management from these financial institutions, ensuring that all their activities always follow the principle of transparency and clarity. At the same time, the exchange is committed to protecting the interests of customers and providing comprehensive support in all situations.

Asset fund protection policy

For many investors, the protection of assets during trading is always a matter of concern. Therefore, IC Markets has always had an extremely strict customer asset protection policy:

- Customers’ funds at ICMarkets will be safe when at reputable banks in Australia such as Westpac and NAB. In particular, the client’s account balance is managed completely independently and separately from the company’s operating funds. The exchange does not use any of the client’s financial resources for any other purpose.

- IC Markets audits are conducted independently by leading global auditing firms. This ensures transparency and honesty in client asset management, and creates more confidence in the operation of the exchange.

IC Markets trading assets

ICMarkets is famous as a broker that offers a wide range of trading products. Currently, this exchange offers more than 2000 products divided into 7 distinct asset groups, opening the door to easier access to financial markets for investors. Products traders can trade when joining IC Markets:

- Forex: 61+ currency pairs with deep liquidity and bid-ask spreads from as little as 0.0 pips.

- Commodities: 22+ commonly traded commodities such as energy, agricultural products and metals. Both Spot and Forward CFDs are available with low leverage, spreads from as little as 0.0 pips.

- Indices: 23+ indices give traders access to global stock markets with extremely low spreads.

- Bonds: Trade 9 types of government-issued bonds, including Japan, Europe, UK, and US.

- Cryptocurrencies: 21+ cryptocurrencies DSH, XRP, EOS, BTC, ETH, LTC and many more.

- Stocks: 1800+ tickers, CFDs on ETFs at ASX, NYSE and NASDAQ.

- Forward contracts: 4 types of forward contracts in many places such as ICE Dollar index, CBOE VIX, Brent Crude Oil…

IC Markets trading platform

In addition to commonly used trading platforms such as MT4 and MT5, ICMarkets also supports the main platform, cTrader. These three platforms are all designed to best meet the trading needs of customers, ensuring stability and fast speed without interruption. Furthermore, all platforms are available and compatible on mobile devices, providing a flexible and convenient experience for investors.

MT4 and MT5 Platforms

MT4 and MT5 are two of the most popular trading platforms in the Forex industry today. The factor that makes this platform so popular stems from its friendly interface, easy to use along with many optimal features. In particular, after launching MT5 has overcome some disadvantages that previous MT4 encountered.

Typical features integrated on MT4 and MT5 here include:

Both IC Markets MT4 and MT5 are located at Equinix NY4 – the data center in New York, providing extremely fast execution speed.

Supports transactions made with a variety of products.

Connection to Raw Pricing provides access to leading liquidity providers globally.

There is no limit on the size of the trade, so traders can place small orders from 0.01 lots and have no restrictions on the maximum size.

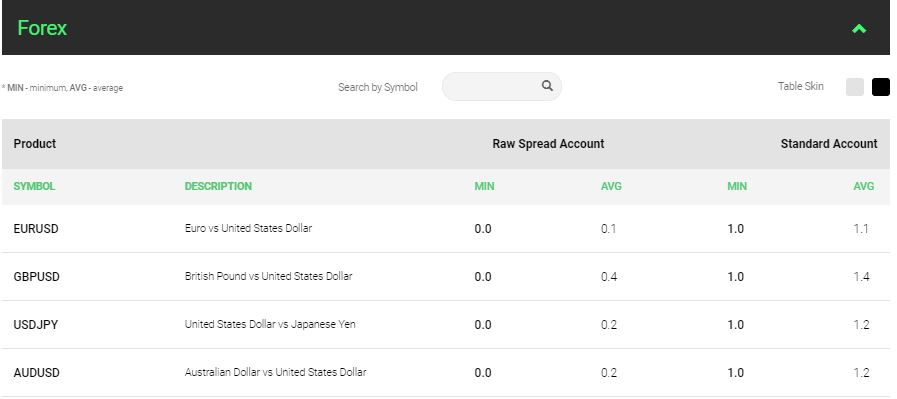

Spreads from 0.0 pips, EUR/USD average spreads reach a global low of just 0.1 pips.

In short, MT4 and MT5 at IC offer reliable and efficient trading experiences with a focus on speed, product variety and low deviation in price.

cTrader platform

cTrader is developed by Systems Ltd from the UK, is one of the popular trading platforms and is used by many exchanges, including ICMarkets.

Although launched after MT4 and MT5, cTrader still has its own outstanding advantages and features:

- Connect Raw Pricing, providing access to deep liquidity.

- The cTrader server is located at LD5 IBX Equinix – the data center in London, helping to ensure extremely fast execution speed.

- Provide accurate forex and CFD quotes in real time.

- Micro-lot trading is allowed, with a minimum lot size of 0.01 and no maximum limit.

- Trade quickly and easily with just one click.

- Smart stop-out system: When the asset drops to the stop-out level, cTrader will automatically close part of the loss order to bring it back to the allowed level.

If you have never experienced cTrader, give it a try, surely the features of cTrader will not disappoint you.

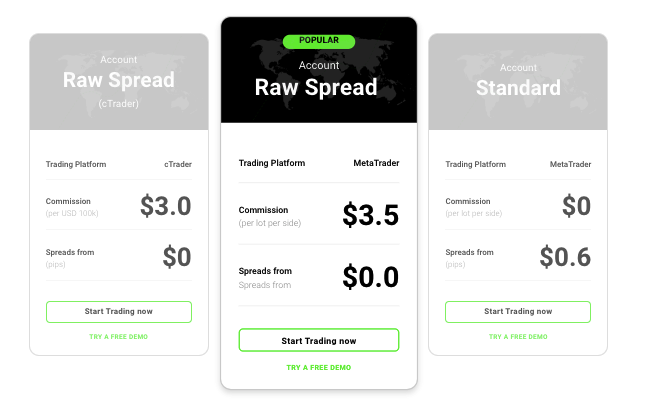

ICMarkets account

IC Markets currently offers 3 trading accounts, designed to suit all types of customers. Each account type will have its own characteristics and transaction fees, so before deciding to open an account, you should research carefully.

cTrader account

This is an option for traders using the cTrader platform, where execution is fast and spreads are as low as 0.0 pips. Connected to Raw Pricing and deep liquidity, this account is suitable for short-term scalping and day trading.

Raw Spread account

The Raw Spread account is specially offered for traders who use EAs (Expert Advisors) and do scalping trades. In addition to low spreads, this account also charges a small commission from 3.5 USD/lot. In particular, Raw Spread also connects with more than 25 banks and other hidden liquidity sources to provide accurate quotes, deep liquidity and superior execution speed.

Standard account

This account type at IC Markets does not have a commission, however the spread will not start from 0.0 pips but instead at 0.6 pips. Standard accounts are generally suitable for traders who have a frequent need to customize their trading.

To better understand the types of trading accounts, you can refer to the comparison table below:

| Account Type | cTrader | Raw Spread | Standard |

| Trading platform | cTrader | MT4/MT5 | MT4/MT5 |

| Minimum deposit | $200 | $200 | $200 |

| Commission | $3.0 | $3.5 | $0.0 |

| Leverage | 1:500 | 1:500 | 1:500 |

| Minimum lot | 0.01 | 0.01 | 0.01 |

| Maximum order | 200 | 200 | 200 |

| Currency Pairs | 61 | 61 | 61 |

| Stop out | 50% | 50% | 50% |

| Spread | From 0.0 pip | From 0.0 pip | From 0.6 pip |

| Server | London | New York | New York |

| Trading style | Day trading & Scalping | EA & Scalping | Custom Trader |

In general, all accounts on IC require a minimum deposit of $200. For experienced traders with large capital, this margin level is not difficult. But for traders who are just starting to trade, consider carefully before deciding which account to choose.

IC Exchange Fee

Transaction fees often play an important role in investors’ decision to participate. Because these fees will directly affect the profit that investors can earn. Specifically at ICMarkets, you will be subject to the following fees:

ICMarkets exchange spread

Currently, the exchange offers very low spreads, from only 0.0 pips. However, spreads may vary depending on the type of account and trading product. The standard account has floating spreads from 0.6 pips, while the other two account types have spreads from 0.0 pips. Notably, the EUR/USD currency pair has a spread of 0.1 pips 24/5 – the lowest spread in the market. Spreads for other products will change dynamically according to market fluctuations.

Overnight Fee

Swap fee (swap fee) is only applicable when a trader opens an overnight position and is calculated from 00:00 MT4 server time. The overnight fee will depend on the type of asset the investor is trading.

Commission

IC’s standard account will not be subject to commission fees. Meanwhile, Raw Spread account will have a commission fee of 3$ per lot/1 way. cTrader account will be charged a commission fee of $3.5 per lot/1 way. Although the standard account is commission-free, it has to accept a higher spread.

Leverage

The maximum leverage applied to all account types on IC Markets is 1:500. However, leverage also depends on the specific type of trading product, as follows:

- Forex: 1:500

- Goods: 1:500

- Index: 1:200

- Bonds: 1:200

- Forward contract: 1:200

- Crypto: 1:200 on MT4/MT5 and 1:5 on cTrader.

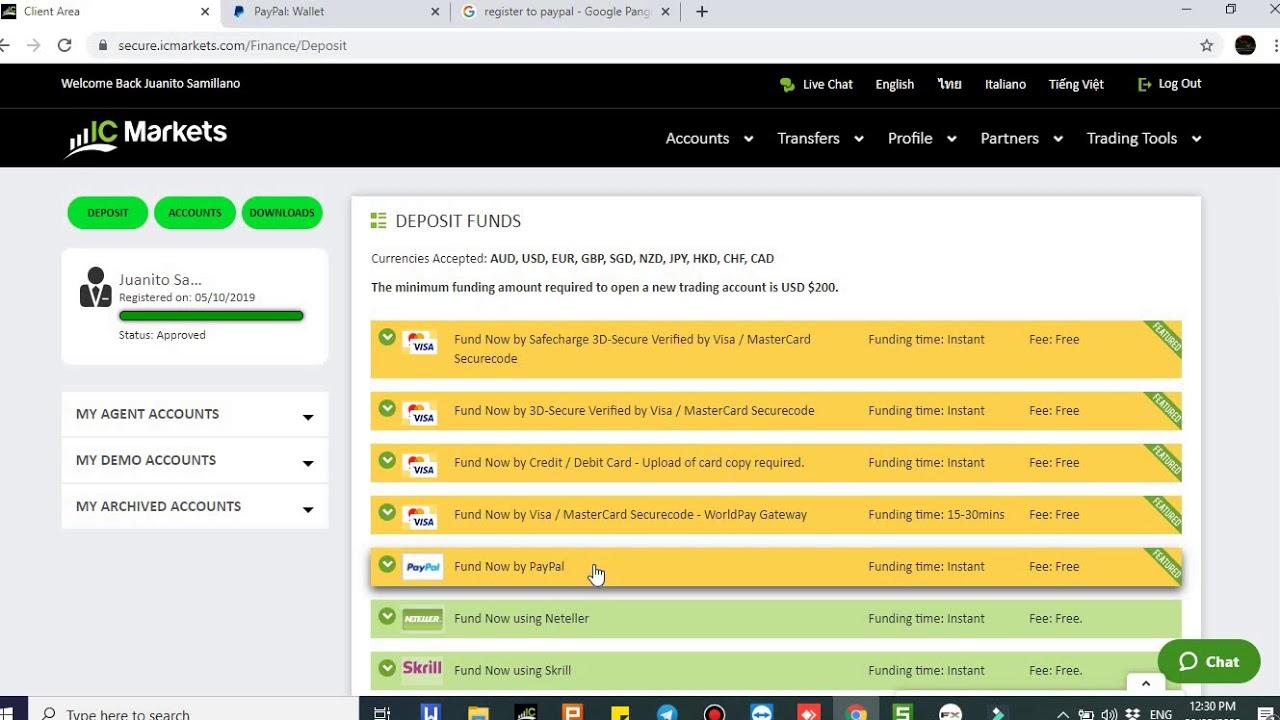

Deposit – withdraw money from IC Markets

To better understand the method and time of depositing and withdrawing money at ICMarket, please follow the content below.

Deposit and withdraw

IC Market deposit – withdrawal is highly appreciated by customers when there are 15 options with 10 currencies: USD, EUR, AUD, GBP, JPY, HKD, CHF, NZD, … Through the form:

- Transfer

- Credit, Debit and PayPal

- Neteller, Skrill

- UnionPay, Bpay, FasaPay

- Wire transfer

- The broker transfers funds to the broker…

In particular, the method of depositing and withdrawing money via Internet Banking is a suitable choice for traders in Vietnam. There are no fees associated with deposits or withdrawals at IC Market. It is possible, nevertheless, that the investor will be charged a fee by a bank or broker, for example.

Deposit/withdrawal time

IC Markets always aims to bring the best experience to traders during trading. As a result, deposits and withdrawals are both processed quickly:

- Deposit by bank transfer: Processing time is about 15-20 minutes.

- Recharge through BPay platform: Processing time from 12 to 48 hours. If transferring from another broker, it will take 2-5 business days to process.

- Withdrawal to credit/debit card: Processing time can be from 3 to 5 business days.

- Withdrawal by Paypal / Neteller / Skrill: Processing time only takes about 2 seconds.

You should also note that processing times can vary depending on various factors.

IC Markets Customer Care Service

ICMarkets customer service is highly appreciated for its professionalism. The customer service staff here are all experienced in the forex market and are able to support customers in many different languages, especially Vietnamese. When you have any problems or questions related to your account, fees, deposits and withdrawals, you can contact IC Markets for answers through the following form:

- Live chat on website

- Email: support@icmarkets.com

- Hotline: +248 467 19 76/+8412032513

- Leave a message, comment in the contact page.

However, this exchange currently does not have an office in Vietnam, which has limitations for customer support services. If you are not fluent in English, there may be some difficulties, as Vietnamese consultants are usually very busy. Waiting to be served can also take quite a while.

Utilities on IC Markets

ICMarkets offers a wide range of special tools for investors, however the use of these services may incur additional fees. You can refer to the information related to the tools right below.

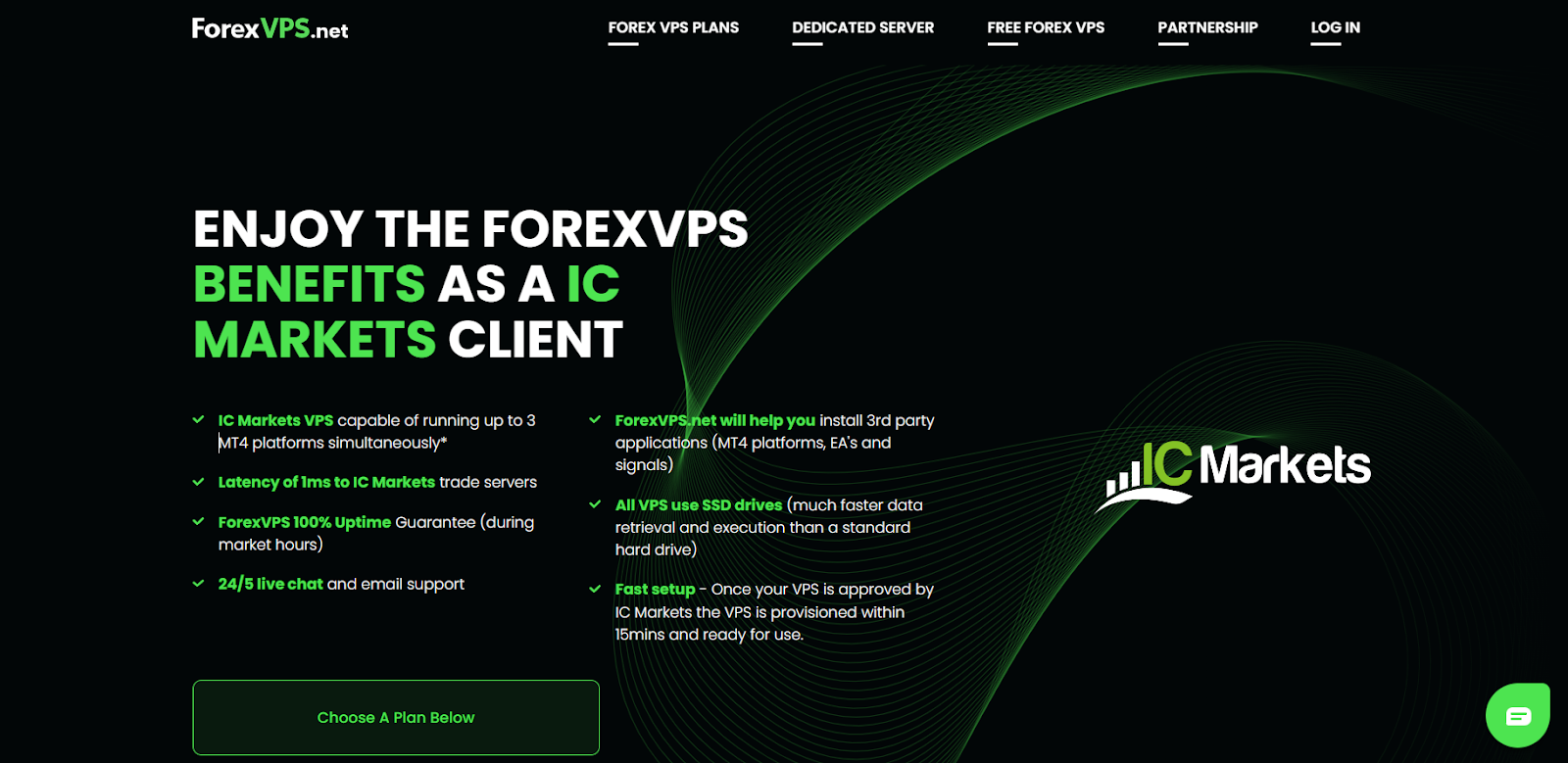

VSP Service

IC provides VPS services through 3 partner companies, Beeks FX VPS, ForexVPs.net and New York Server. This service is provided through a monthly subscription process, the broker will pay a fee to the client if the trading volume exceeds 15 lots per month.

MAM/PAMM account

IC Markets provides an account management service to traders on its platform, allowing account managers to execute trades on behalf of investors. To participate in this service, you need to open a MAM/PAMM account. The MAM software provides direct access to settings from the broker’s MT4 server.

The MAM service, or Multi-Account Manager, allows you to customize the transaction allocation flexibly. The full PAMM is Percentage Allocation Module Manager, which refers to a group of investors, sub-accounts traded together by a money manager. These managers will receive a portion of the profits from the trades made.

MT4 Advanced Trading Tools

IC Markets has added 20 unique, exclusive tools that are only available on the MetaTrader 4 platform. These tools were developed to help traders manage risk and control trades from a single terminal. best. Also, monitor the correlation between different forex pairs and contracts for difference.

The toolkit includes:

- Complex warning

- Session Map

- Broadcasting equipment

- Emotional trading

- Correlation Matrix

- Data and functionality…

Myfxbook Autotrade

Myfxbook Autotrade is one of the most popular copy trading tools on the market today. This tool allows investors to copy trades from systems of their choice directly on IC Markets MT4 platform. Autotrade applies a spread of 0.6 pips to all accounts.

One of the important advantages of Myfxbook Autotrade is the variety of features. It offers multiple copy trading modes and unlimited number of strategists. This is really useful for traders who are passionate about financial markets but lack experience.

Zulutrade

Zulutrade is a third party service, peer-to-peer social trading application, where traders can select participating traders from 192 countries. Traders are ranked based on “ZuluRank,” using metrics such as overall performance, stability, uptime, engagement, and minimum capital required. To use this service, investors will have to pay a mark-up/spread fee of up to 2.2 pips.

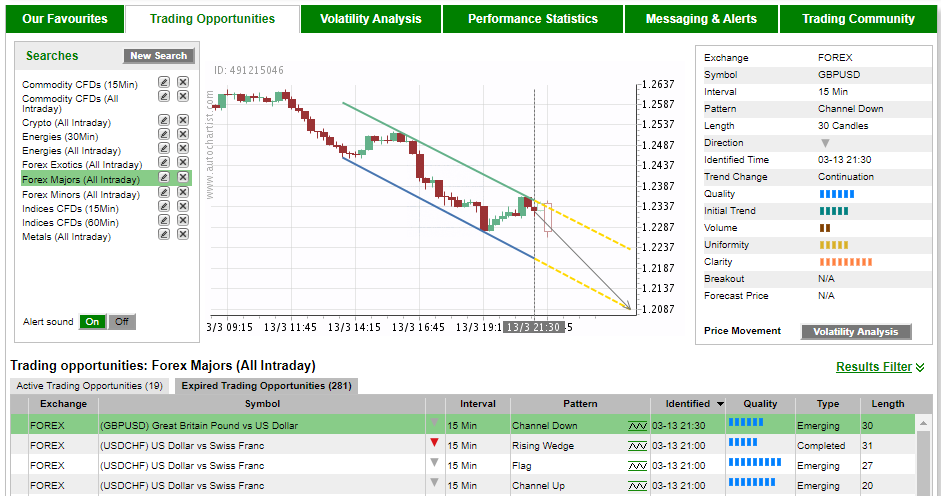

Autochartist

Autochartist is an automated market analysis service. It is integrated through the IC Markets partner program. This means there will be an additional cost associated with using this resource. Traders can get in touch with the service’s support team to learn more about the service’s pricing structure.

The Autochartist service tracks over 250 different forex pairs and contracts for difference 24 hours a day. It automatically alerts investors to potential trading opportunities and creates trends, with a high degree of price forecasting accuracy. The main functions of Autochartist include:

- Sample quality indicator

- Diagram pattern recognition

- Fibonacci pattern recognition

- Major level analysis

- Autochartist belongs to the list of the most effective technical analysis services in the financial markets.

Trading Central

The Trading Central service also known as the Trading Center will only be provided to customers who open a live account. This is a third party service in which experts from the Trading Center use the most advanced and modern technical analysis tools to manage the relevant data. The main function of this service is to assist traders without technical knowledge in making trading decisions.

Conclusion about IC Markets

Before you make the decision to enter into trading on any forex broker, it is important that you do a thorough research on the information that will help you make your decision whether to enter trading here or not.

Advantage

The outstanding advantages you should not miss at IC exchange:

- Many reputable financial institutions license such as ASIC, CySEC, FSA

- Low Spreads

- Super competitive commissions

- Deposit/withdrawal of various methods, fast time

- Diverse trading products, deep liquidity.

Disadvantage

Some limitations that cannot be overcome at IC Markets:

- The minimum deposit is as high as $200.

- Low maximum leverage only 1:500

- No offer

- There is no information about the awards of the exchange.

FAQ

Which country’s ICMarkets?

IC Markets is a forex broker headquartered in Sydney, Australia.

Is ICMarkets cheating customers right?

The answer is no because IC Markets has been operating for more than 15 years in the financial markets and is licensed by major financial institutions: FSA, ASIC, CYSEC and SCB. These organizations will monitor the activities at the IC, so when detecting signs of fraud, the IC cannot operate to this day.

What is the minimum money at ICMarkets?

This exchange requires investors to deposit a minimum of $200 for all account types.

IC Markets is ECN or hug order?

ICMarkets is an ECN trading platform, investors’ orders will be sent directly to the market, so they don’t hug the exchange, don’t be afraid to hold orders or edit orders.

How many IC Markets trading accounts can be opened?

ICMarkets does not limit the maximum number of investor accounts that can be opened, so you are allowed to open multiple accounts at the same time.

With the information related to IC Markets shared above, it will help traders understand this exchange. If you have any questions regarding this broker, please contact or contact TraderForex for advice immediately.