In an age where innovation and connectivity have reshaped industries, the financial sector is no exception. Crowdinvesting, a revolutionary financial concept, has disrupted the traditional investment landscape. This article sheds light on crowdinvesting’s profound impact on real estate, providing readers with a comprehensive understanding of its dynamics and implications.

Understanding Crowdinvesting

Defining Crowdinvesting

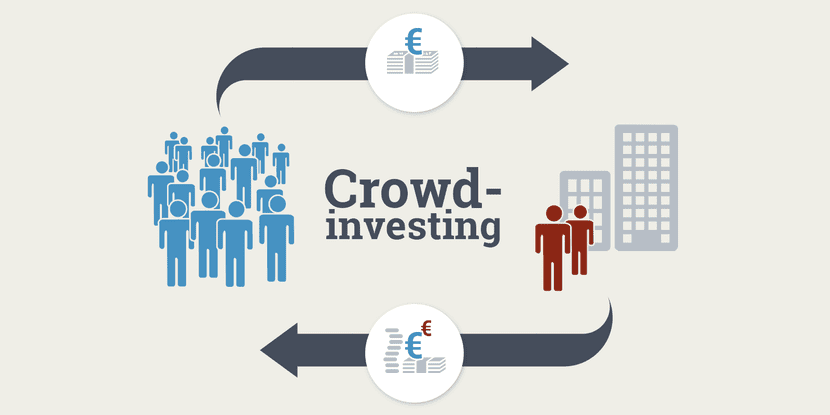

Crowdinvesting, often interchangeably referred to as crowdfunding, entails raising funds from a large number of individuals, often through online platforms. Unlike traditional investments where a few affluent investors dominate, crowdinvesting opens up opportunities for a broader range of investors, including those with modest financial means.

The Mechanism Behind Crowdinvesting

At its core, crowd investing real estate operates on the principle of collective contributions. Individuals invest relatively small amounts of money in a particular venture, which collectively accumulates into a substantial fund. This fund is then utilized to finance various projects, including real estate developments.

The Emergence of Crowdinvesting in Real Estate

Traditional Real Estate Investment vs. Crowdinvesting

Historically, real estate investment was reserved for wealthy individuals or institutional investors. However, crowdinvesting has democratized real estate investment website by allowing people to invest with minimal financial thresholds. This democratization has not only opened avenues for investment but has also transformed the dynamics of property ownership.

Benefits and Drawbacks of Crowdinvesting in Real Estate

Crowdinvesting offers numerous benefits, such as increased access to investment opportunities, portfolio diversification, and the potential for higher returns. However, it’s important to acknowledge the drawbacks, including limited control over investment decisions and potential risks associated with project execution.

Navigating Crowdinvesting Platforms

How Crowdinvesting Platforms Operate

Crowdinvesting platforms act as intermediaries that connect investors with real estate developers seeking funding. These platforms provide detailed project information, financial projections, and risk assessments, enabling investors to make informed decisions.

Due Diligence and Risk Assessment

Before investing, individuals must conduct thorough due diligence. This involves assessing the credibility of the project, evaluating the developer’s track record, and analyzing the potential risks involved. Many crowdinvesting platforms facilitate this process by offering comprehensive project details and risk profiles.

Unlocking Opportunities: Crowdinvesting Success Stories

Case Study 1: Urban Renewal Project in Downtown Metropolis

In 20XX, a pioneering urban renewal project transformed a dilapidated downtown area into a thriving commercial and residential hub. Through a crowdinvesting platform, hundreds of small investors contributed to the project, sharing in its success and the subsequent increase in property value.

Case Study 2: Luxury Resort Expansion on Exotic Island

A picturesque island witnessed the expansion of a luxury resort through crowdinvesting. By offering fractional ownership of resort villas, the project garnered significant attention from investors looking for unique real estate opportunities.

The Role of Technology and Transparency

Utilizing Technology for Enhanced Access

Crowdinvesting platforms leverage technology to make investment opportunities accessible to a global audience. Through user-friendly interfaces, investors can browse projects, review documents, and even monitor their investments in real-time.

Ensuring Transparency and Investor Confidence

Transparency is paramount in crowdinvesting. Platforms disclose project details, financial forecasts, and potential risks, empowering investors to make well-informed decisions. This transparency not only fosters confidence but also helps in building long-term investor relationships.

Regulatory Landscape and Investor Protection

Legal Framework Surrounding Crowdinvesting

As crowdinvesting gained popularity, regulatory bodies developed frameworks to govern the practice. These regulations vary by jurisdiction and often focus on investor protection, disclosure requirements, and limitations on investment amounts.

Safeguarding Investor Interests

Investor protection measures, such as mandatory disclosures, background checks on project developers, and escrow accounts for funds, have been implemented to mitigate potential risks. These safeguards aim to strike a balance between encouraging investment and ensuring investor security.

Future Prospects and Trends

Integration of Blockchain Technology

Blockchain technology is gradually making its way into the crowdinvesting landscape. By enhancing transparency, security, and reducing intermediaries, blockchain has the potential to revolutionize how investments are executed and tracked.

Diversification of Crowdinvesting Portfolios

As investors become more comfortable with crowdinvesting, diversification is emerging as a key strategy. Investors are allocating funds across various projects and sectors, mitigating risks and optimizing potential returns.

Conclusion

Crowdinvesting has reshaped the real estate investment landscape, offering unprecedented access to opportunities that were once out of reach for the average individual. This innovative approach has democratized investment, fostered transparency, and paved the way for a more inclusive financial future.