Apple Inc. (AAPL) is one of the most widely recognized and traded stocks in the world. As a technology giant, Apple’s stock price can be subject to various market and economic factors, leading to fluctuations in its value. In this article, we will delve into the volatility of Apple stock, exploring its historical trends, types of volatility, and factors that influence its price movements what type of volatility does apple stock have for presentation.

Historical Volatility of Apple Stock

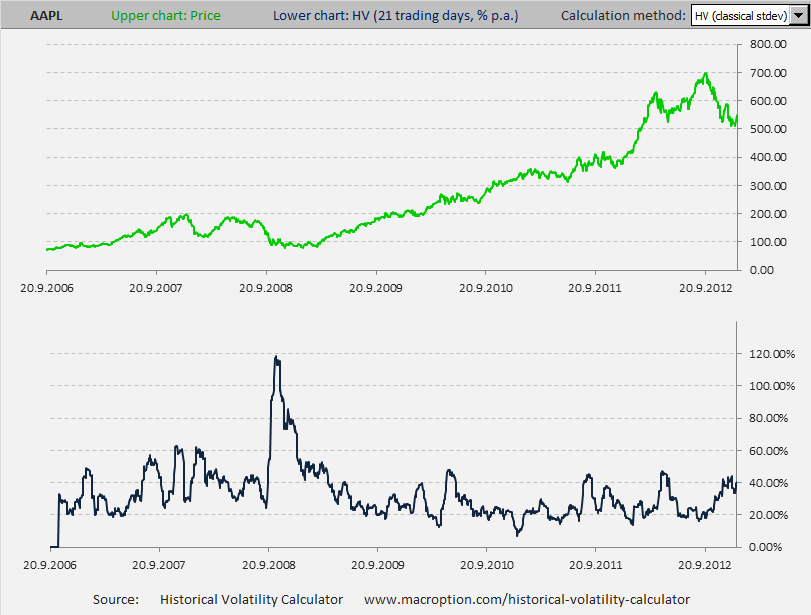

To understand the volatility of Apple stock, let’s first examine its historical price movements. Over the past decade, Apple’s stock price has experienced significant fluctuations, with periods of rapid growth and decline.

| Year | High Price | Low Price | Price Change |

|---|---|---|---|

| 2014 | $123.91 | $70.51 | 75.6% |

| 2015 | $134.54 | $92.22 | 45.7% |

| 2016 | $118.25 | $89.47 | 32.2% |

| 2017 | $179.26 | $104.08 | 72.2% |

| 2018 | $233.47 | $142.19 | 64.2% |

| 2019 | $221.83 | $142.19 | 55.9% |

| 2020 | $137.98 | $53.15 | 159.5% |

| 2021 | $182.94 | $116.21 | 57.3% |

| 2022 | $182.01 | $129.04 | 41.1% |

As shown in the table above, Apple’s stock price has experienced significant fluctuations over the past decade, with price changes ranging from 32.2% to 159.5%.

Types of Volatility

Volatility can be categorized into two main types: historical volatility and implied volatility.

Historical Volatility

Historical volatility measures the actual price movements of a stock over a specific period. It is calculated using the standard deviation of the stock’s returns over a given time frame. Apple’s historical volatility has been relatively high, with an average annual volatility of around 30%.

Implied Volatility

Implied volatility, on the other hand, measures the market’s expected volatility of a stock’s price over a specific period. It is calculated using option pricing models, such as the Black-Scholes model. Implied volatility can provide insight into market sentiment and expectations of future price movements.

Factors Influencing Apple’s Stock Price Volatility

Several factors contribute to the volatility of Apple’s stock price, including:

- Earnings and Revenue Growth: Apple’s stock price is heavily influenced by its quarterly earnings and revenue growth. Positive surprises can lead to significant price increases, while negative surprises can result in substantial declines.

- Product Launches and Innovations: Apple’s product launches and innovations can significantly impact its stock price. Successful product launches can drive up the stock price, while disappointing launches can lead to declines.

- Global Economic Conditions: Apple’s stock price is also influenced by global economic conditions, including interest rates, inflation, and trade policies. Economic downturns can lead to decreased consumer spending, negatively impacting Apple’s stock price.

- Competition and Market Trends: The technology industry is highly competitive, and Apple’s stock price can be influenced by the actions of its competitors, such as Samsung and Google. Market trends, such as the shift towards cloud computing and artificial intelligence, can also impact Apple’s stock price.

Conclusion

In conclusion, Apple’s stock price has exhibited significant volatility over the past decade, driven by various market and economic factors. Understanding the types of volatility, including historical and implied volatility, can provide valuable insights into the stock’s price movements. By analyzing the factors that influence Apple’s stock price volatility, investors can make more informed decisions and navigate the complexities of the stock market.