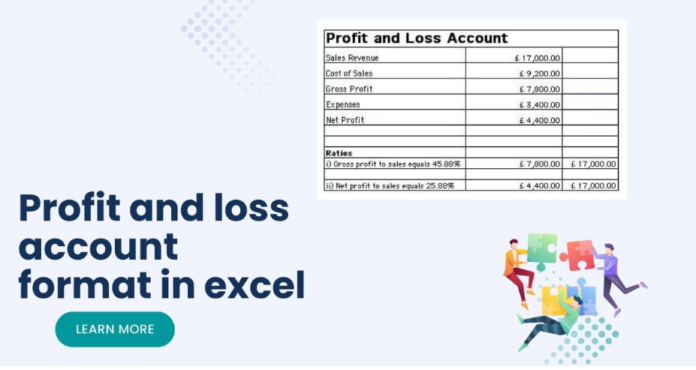

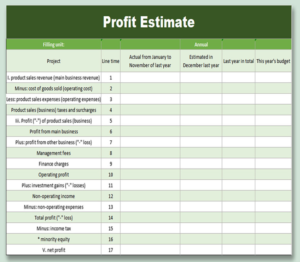

A Profit and Loss Account, also known as an Income Statement, is a financial statement that summarizes a company’s revenues, expenses, and profits over a specific period. It provides valuable insights into a company’s financial performance and is essential for decision-making and analysis. Creating a well-organized profit and loss account format in excel can help businesses monitor their financial health and make informed business decisions. In this guide, we’ll walk you through the step-by-step process of setting up a Profit and Loss Account format in Excel.

Step 1: Set Up the Spreadsheet

- Open Microsoft Excel and create a new google spreadsheet.

- In the first row, input the heading “Profit and Loss Account” or “Income Statement” at the top cell (A1).

- Create four columns: “Description,” “Amount,” “Revenue,” and “Expenses.” Label these columns in cells A3, B3, C3, and D3, respectively.

Step 2: List Revenue Items

- Starting from cell A4, list all revenue items for the specific period. These can include sales, service income, interest income, etc. Enter each item in separate rows under the “Description” column.

- Enter the corresponding revenue amounts for each item in the “Amount” column (column B). These amounts should reflect the revenue generated from each item during the period.

Step 3: Calculate Total Revenue

- In cell B13 (or any empty cell below the revenue items), use the SUM function to calculate the total revenue. For example, use “=SUM(B4:B12)” to sum all the revenue amounts from B4 to B12.

- Label this cell as “Total Revenue.

Step 4: List Expense Items

- Starting from cell A14, list all expense items for the specific period. These can include costs of goods sold, operating expenses, taxes, etc. Enter each item in separate rows under the “Description” column.

- Enter the corresponding expense amounts for each item in the “Amount” column (column B). These amounts should reflect the expenses incurred for each item during the period.

Step 5: Calculate Total Expenses

- In cell B23 (or any empty cell below the expense items), use the SUM function to calculate the total expenses. For example, use “=SUM(B14:B22)” to sum all the expense amounts from B14 to B22.

- Label this cell as “Total Expenses.”

Step 6: Calculate Net Profit (Loss)

- In cell B25 (or any empty cell below the total expenses), calculate the net profit (loss) by deducting total family tree template free expenses from total revenue. For example, use the formula “=B13-B23” to calculate the net profit (loss).

- Label this cell as “Net Profit (Loss).”

Step 7: Format the Spreadsheet

- Format the cells and text to make the Profit and Loss Account visually appealing and easy to read.

- Apply bold formatting to the headers and totals to make them stand out.

- Use borders to separate revenue items, expense items, and totals for better clarity.

Step 8: Review and Verify

- Double-check all the entered data and formulas to ensure accuracy.

- Verify that the net profit (loss) is calculated correctly and reflects the financial performance for the period.

Conclusion

Creating a Profit and Loss Account format in Excel provides businesses with a clear overview of their financial performance. By systematically organizing revenue and expense items and calculating the net profit (loss), companies can gain valuable insights into their financial health. Excel’s flexibility and usability make it an excellent tool for businesses of all sizes to track their profits and losses efficiently. With a well-structured Profit and Loss Account in Excel, businesses can make informed decisions, identify areas for improvement, and work towards financial success.