One of the most popular technical indicators, crypto rsi is used to identify the rate at which a cryptocurrency is moving. Traders use this indicator to gauge the market’s bullish or bearish momentum and identify potential reversal zones.

RSI Explained

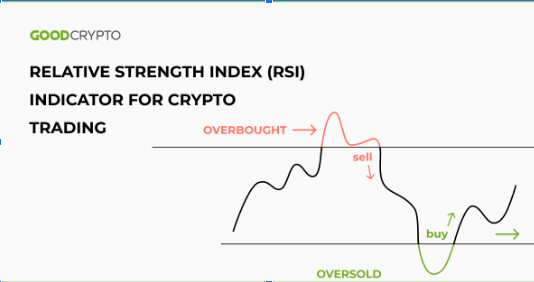

The relative strength index (RSI) is an indicator that measures momentum and can be found on most cryptocurrency charts. Developed by Welles Wilder in 1978, this indicator has gained widespread popularity due to its ability to detect overbought and oversold conditions. RSI can score from 0 to 100 and oscillates between the two extremes.

RSI is a momentum indicator and uses a formula that takes the average of upward price changes and divides it by the average of downward price changes across 14 most recent periods or candles. The formula determines whether the RSI value is bullish or bearish, and traders can interpret this signal to enter or exit a trade depending on their preferences.

How to Use the RSI Indicator

When a crypto’s RSI value goes above 70, it indicates that the coin is overbought. Similarly, when the RSI value goes below 30 it indicates that the coin is oversold. This can help you spot potential reversal areas in the price and get better trading signals.

How to Use the RSI in Ranged Markets

The RSI is most effective when a crypto is trading in ranges. This is because the RSI value can remain overbought or oversold for long periods of time. It is therefore recommended that you use a wider timeframe such as the daily or weekly timeframes when looking for RSI signals in a ranged market.

How to Use the RSI Divergence Indicator

The Relative Strength Index (RSI) is an important indicator in crypto trading, and it can provide you with consistent buy and sell signals when combined with other trend indicators such as MACD. By using RSI in conjunction with other indicators, you can improve your overall trading strategies and gain more insight into the market.

RSI is an essential tool for any trader, and it’s easy to use. Its simplicity and versatility make it a great way to learn the basics of technical analysis and gain confidence in crypto trading.

When to Look for RSI Divergence

There are two types of RSI divergence that traders should watch out for: the bearish and the bullish type. The bearish type of RSI divergence occurs when the price of a coin makes a new high while the RSI does not confirm that new high. The bearish type of RSI Divergence is a sign that the price is fading and that it will be soon corrected.

How to use RSI in conjunction with MACD

The Moving Average Convergence Divergence (MACD) is a popular charting tool that compares two exponential moving averages, a bullish MACD and a bearish MACD. This helps to identify trend reversals and can be used in conjunction with RSI.

RSI is a powerful tool, but it’s also important to remember that not all signals are equally valid and accurate. MACD can provide more accurate signals than RSI, and it’s best to use both of them together to find the best entry and exit points for your trades.