The global eSports industry was worth USD 1.22 billion in 2021 and is predicted to go up to USD 1.44 billion in 2022. The market is anticipated to reach USD 5.48 billion by 2029, growing at a 21.0% CAGR during the forecast period. Increasing the number of live-streaming events and income opportunities will likely have a positive market impact. Significant investments, increased live streaming events of games, engagement activities, growing viewership, and league tournament infrastructure are expected to accelerate the market trajectory. The growing amount of e-sports commercials on online platforms is driving market expansion.

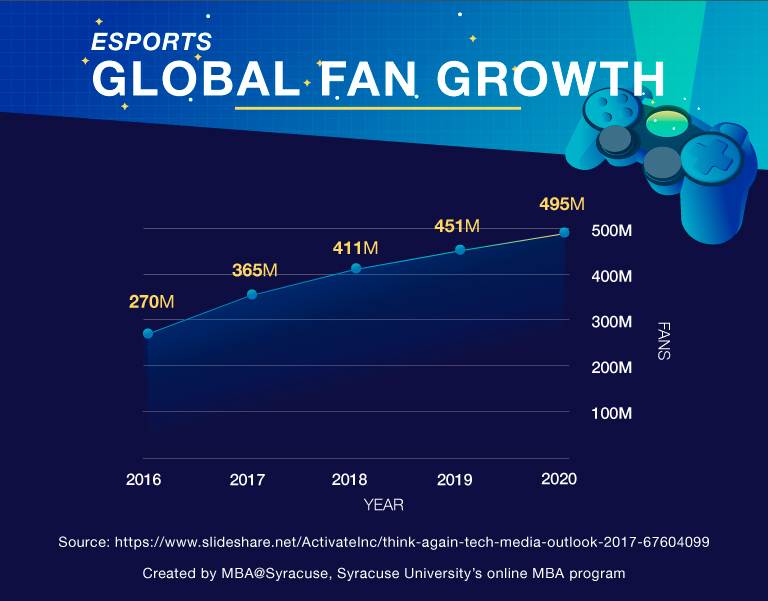

With the growth of the esports phenomenon, viewers may now easily watch games at an organized arena event. The market’s audience size and income have grown significantly in recent years. The expanding audience contributed substantially to the increase in sponsorship revenue received by tournament/championship organizers. Streaming firms are investing in esports marketing due to the ability to reach a large and active audience, both directly and indirectly. This element aided in the rise of exclusivity in the sector. The International Olympic Committee has even discussed including esports in future Olympic tournaments. DouYu, YouTube, Twitch, and Huya are just a few online video streaming services that have proven indispensable for establishing and marketing esports competitions.

How Do Teams and Players Make Money?

Esports teams and players typically fight for prize money, one of the more visible ways to make money in esports. The most fantastic paying game in September 2021 was Dota 2, a multiplayer online battle arena computer game. The game set the record for the most remarkable overall prize pool with nearly $34 million. Although prize money can be huge, many esports teams rely on sponsors for more consistent income.

Adidas and Spotify are well-known brands that sponsor esports teams and organizers. Spotify announced its first-ever esports agreement with Riot Games in 2020, becoming League of Legends’ official audio streaming partner.

Another significant business investing in esports is the National Basketball Association. The NBA 2K League, named after a popular video game series, was introduced by the NBA in 2018. The esports teams are owned by NBA teams such as the Boston Celtics and Los Angeles Lakers, giving basketball fans access to esports.

Individual esports players can get cash through their streams as well. Tyler Blevins, better known as Ninja, is arguably the most well-known streamer in the esports sector. According to Twitchmetrics, he had the most incredible following on the streaming platform Twitch as of August 2022, with about 18 million followers, and Forbes said that he earned $17 million in 2019. Viewers of Ninja’s streams can donate to him while he is streaming live. These contributions can range from $1 to $100 and occasionally much more. His sponsors have included well-known companies such as Uber Eats and Red Bull.

European Market Growth

The Asia-Pacific (APAC) market is the largest in the esports sector, accounting for 57 per cent of worldwide esports viewership in 2019 and home to an impressive 1.5 billion players. In comparison, the European market is significantly less saturated and home to many players who have yet to enter the world of esports. Europe accounts for only roughly $138 million of worldwide esports income.

Along with Latin America, companies targeting the European esports market have the potential for long-term growth, given the industry’s present state of development in these regions.

Live Esports Betting

Although contentious, betting is one of esports’ most current possible money streams. Given esports’ predominantly young demographic base, there is understandable scepticism about embracing formalized betting inside the ecosystem.

However, betting and gambling already occur on the grey market and at institutional levels in esports and traditional sports. Future collaborations between esports corporations and betting firms allow the industry to oversee and regulate esports betting appropriately, reducing the grey market and bringing in considerable new revenue. It is currently possible to place legal Esports bets on all Esports titles, such as Dota 2, Lol and other famous titles, so there is no need for grey market in that regard.

Regional Insights

Asia-Pacific will have the most significant market share, growing at a 21.92% CAGR by 2030. The region’s growing number of internet users and mobile gamers has spurred the expansion of esports. Since China proclaimed esports an official sport in 2003, the business has created affluent employment prospects for the country’s esports operators. South Korea, a well-known esports country, offers players a standard infrastructure that includes instructors, gaming venues, analysts, and cooks. Several market-related activities and improvements are expected to fuel significant growth during the forecast period.

China has a massive impact on the growth of the Asia-Pacific esports business. Several foreign companies are entering the sector through stock purchases in Chinese gaming companies or by endorsing groups of professional gamers. At top-tier esports tournaments in China, players compete in open-access online venues, and companies such as Alibaba Group are increasing their investments in these events. Six cities in mainland China are competing to become significant esports hubs: Shanghai, Xian, Hangzhou, Hainan, Sanya, Chongqing, and Haikou.

North America is predicted to expand at a CAGR of 21.2% to USD 1,122 million by 2030. The Overwatch League and the licensed North American League of Legends Championship Series are expected to drive further regional growth and investment. Esports in the United States has evolved into a multimillion-dollar industry thanks to the efforts of leagues, players, game developers, streaming providers, and television networks. The North America Scholastic eSports Federation (NASEF) strives to develop the ecosystem by organizing young contests, assisting high schools in establishing esports clubs, and providing coaching and mentoring. Tallo and the North American Scholastic eSports Federation partnered in 2021. The collaboration has created the most extensive online network of corporations, growing esports stars, and academic institutions.

The United States is credited with birthing the esports boom and has one of the world’s largest gaming and esports markets. Many Esports game and equipment firms have their headquarters in this city. Intense gaming penetration, high average customer spending, and a relatively young and attentive populace contribute to the country’s brisk esports business. The North American esports market is expected to grow substantially as viewership and audience numbers increase.

Esports net worth $3 billion by 2022

According to a late 2018 Goldman Sachs research, the esports sector will be worth $3 billion by 2022. It cited Fortnite’s $1 million first-year prize pool, streamer Ninja’s $1 million valuations, and Activision Blizzard’s $90 million Overwatch partnership with Twitch.

These two specific games have both blown these deals away in the period since this report. Epic Games’ Fortnite intentions make a $1 million prize pool appear insignificant. The Fortnite World Cup they hosted featured a total prize fund of £30 million. Kyle “Bugha” Geirsdorf, the champion of the Fortnite Solo, received an individual award. He won the Fortnite World Cup with $3 million in prize money despite being only 16 years old. These prize pools aren’t the most important contributors to the value of the esports business in 2022, but they indicate the amount of money pouring in and out of these events.

The other game cited in this article was Overwatch, which has surpassed its previous highs in terms of deals. They had negotiated a $90 million agreement with Twitch but would later switch to YouTube. The cost of exclusivity with YouTube was $160 million. Overwatch and the Call of Duty League have seen considerable growth for that company, adding considerably to Activison’s expensive price tag from Microsoft.