The Option Wheel Strategy is a popular, income-generating trading method that leverages options to buy and sell stocks in a systematic and relatively low-risk manner. This strategy is particularly well-suited for traders looking to generate consistent income while owning shares of stock or those willing to acquire stocks at a discounted price. If you’re interested in options trading or building a passive income stream from your investments, understanding the Wheel Strategy is essential.

What is the Option Wheel Strategy?

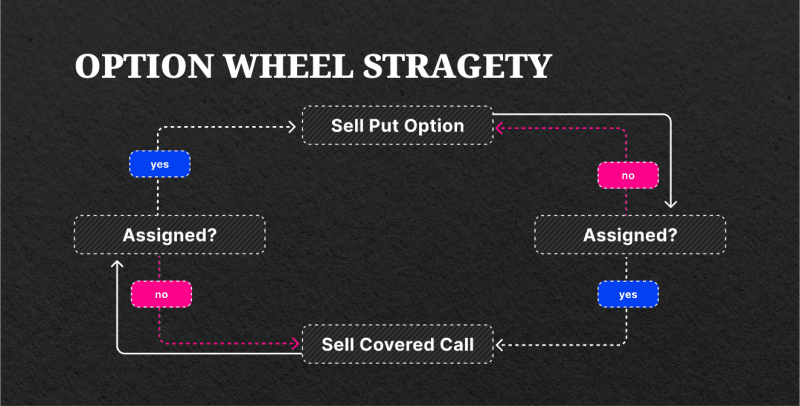

The Option Wheel Strategy is an options trading approach that involves selling cash-secured put options and covered call options in a repeating cycle, or “wheel.” The goal is to generate regular premium income by selling these options while potentially acquiring and selling shares of stock along the way.

In simple terms, this strategy helps traders generate income by selling put options until they are assigned (forced to buy the stock), after which they sell call options against the shares they own. The process repeats in a cycle, resembling the rotation of a wheel, hence the name.

Key Components of the Wheel Strategy:

- Cash-Secured Puts: You sell put options and hold enough cash to buy the stock if the option is assigned.

- Covered Calls: Once you own the stock, you sell call options against it to generate income until the stock is sold.

How the Option Wheel Strategy Works

The Option Wheel Strategy consists of two main stages—selling puts and selling calls. Let’s break it down step-by-step:

Step 1: Sell Cash-Secured Put Options

The process begins by selling cash-secured put options on a stock you wouldn’t mind owning. A put option gives the buyer the right, but not the obligation, to sell the stock to you at a predetermined strike price by the expiration date.

- Cash-Secured: This means you must have enough cash in your trading account to buy 100 shares of the underlying stock at the option’s strike price. For example, if the strike price is $50, you should have $5,000 available (100 shares x $50 per share).

- Premium Income: When you sell the put, you receive a premium upfront, which is the income you earn from this part of the strategy. If the stock price stays above the strike price, the put will expire worthless, and you can keep the premium without buying the stock.

Step 2: Getting Assigned and Acquiring the Stock

If the stock’s price drops below the strike price, the put option will be assigned, meaning you are obligated to buy 100 shares at the strike price. This typically happens when the stock trades at or below the strike price at expiration.

- Discounted Purchase: You end up purchasing the stock at a discount, factoring in the premium you received when selling the put. For example, if you sold a put at a $50 strike price and received a $2 premium, your effective purchase price is $48 per share.

Step 3: Sell Covered Calls on the Stock

Once you own the stock, the next phase of the strategy involves selling covered call options. A call option gives the buyer the right, but not the obligation, to purchase the stock from you at a predetermined strike price by the expiration date.

- Covered: Because you already own the stock, the call option is considered “covered,” meaning you can deliver the shares if the option is exercised.

- Premium Income: As with the put option, you receive a premium for selling the call. If the stock price remains below the strike price, the call expires worthless, and you keep both the stock and the premium.

Step 4: Potentially Sell the Stock and Repeat

If the stock price rises above the strike price, the call option will be exercised, and you will sell the stock at the agreed-upon strike price. This is when you exit your stock position, likely at a profit, considering the premium you received for the call option and the initial stock price.

Once you’ve sold the stock, you return to Step 1, where you start the process again by selling cash-secured puts. The strategy repeats in a cyclical fashion—hence, the term Option Wheel.

Benefits of the Option Wheel Strategy

The Option Wheel Strategy offers several benefits for investors seeking steady income and lower risk compared to outright stock speculation.

1. Consistent Income

The strategy generates consistent premium income by selling both put and call options. Whether the stock rises, falls, or stays flat, you continue earning premiums throughout the process.

2. Buy Stock at a Discount

By selling cash-secured puts, you can potentially acquire stocks you want to own at a discount. If the put option is assigned, the stock’s effective purchase price is reduced by the amount of the premium received.

3. Capital Appreciation Potential

If you end up owning the stock and selling covered calls, there’s potential for capital gains. If the stock rises above the call strike price, you sell the stock at a profit while still keeping the premium from the call option.

4. Risk Management

The risk of the Option Wheel Strategy is mitigated by the fact that you only trade stocks you’re willing to own. Since the put options are cash-secured, you avoid the risk of margin calls or excessive leverage.

5. Diversification

The wheel strategy can be applied to multiple stocks, allowing you to diversify your income sources and reduce your reliance on a single stock or sector.

Risks of the Option Wheel Strategy

While the Option Wheel Strategy is relatively conservative compared to other trading strategies, it does carry certain risks:

1. Stock Price Declines

If the stock price falls significantly after you sell the cash-secured put, you could be forced to buy shares at a higher price than the current market value, leading to a paper loss. However, this risk is minimized if you’re comfortable owning the stock for the long term.

2. Missed Gains

When selling covered calls, your upside is capped at the strike price of the call option. If the stock skyrockets in price, you may miss out on potential gains beyond the strike price.

3. Premiums May Not Offset Losses

Although you receive premium income for selling options, if the stock’s price declines significantly, the premium may not fully offset the loss in value of the stock or the shares you acquire.

4. Market Volatility

Market conditions, such as high volatility, can affect the pricing of options. While higher volatility can lead to higher premiums, it also increases the risk of sudden, unexpected price movements in the underlying stock.

Best Practices for Implementing the Wheel Strategy

To maximize the effectiveness of the Option Wheel Strategy, here are some best practices to keep in mind:

1. Choose the Right Stocks

Focus on quality stocks you wouldn’t mind holding long term. Ideal candidates are companies with strong fundamentals, stable performance, and growth potential. Avoid highly volatile or speculative stocks unless you’re prepared to manage higher risks.

2. Set Realistic Strike Prices

When selecting strike prices for both puts and calls, aim for strike prices that align with your risk tolerance and objectives. For put options, choose a strike price that represents a discount to the current stock price. For call options, select a strike price that allows for reasonable upside while still generating premium income.

3. Monitor Expiration Dates

Timing is crucial when trading options. Choose expiration dates that give you enough flexibility to manage your positions. Shorter expirations (weekly or monthly) tend to offer more premium income opportunities but may require more active management.

4. Stay Consistent

The Option Wheel Strategy is designed to be a long-term approach to generating income and building wealth. Stick to the process, even during periods of volatility or stock price fluctuations. Over time, the strategy can produce reliable income as long as you stay disciplined.

Conclusion

The Option Wheel Strategy is an excellent way for investors to generate consistent income through a combination of cash-secured puts and covered calls. While it requires a basic understanding of options trading, this strategy is relatively low-risk compared to more aggressive approaches. By following the steps outlined in this guide and implementing the strategy with discipline, you can use the Option Wheel to build wealth and enhance your investment portfolio over time.