Today’s trading sphere is saturated with companies vying to create their one-of-a-kind and valuable product that allows traders to work comfortably in the financial markets. The trading application programming interface (API) was developed to combine the benefits of various solutions and streamline the trading process.

This article will define an API and explain how it works. You’ll also discover what a white-label platform is and how trading APIs affect white-label platforms.

What is an API in Trading?

An API (Application Programming Interface) in trading is a set of rules and protocols that allow various software applications to communicate and interact with one another. It enables developers to enhance their product’s functionality and connect it to other products. A program can use an API to request data from another application or to request that it perform a specific operation. In terms of the working mechanism, this solution has gained enormous popularity in the framework of electronic trading, allowing the linking of several products, thus increasing the flexibility of work in the ecosystem of different elements and providing access to financial markets.

How does the API work?

The Application Programming Interface operates on a straightforward principle. A client program requests that an API server perform a specific operation. The interface receives the data and routes it to the application program, which performs the function. The result of the request is then returned to the client in the form of a specific action on the user interface. If the operation fails or the request is invalid, the API generates an error message, which the API technology provider then corrects.

What is a white-label trading platform?

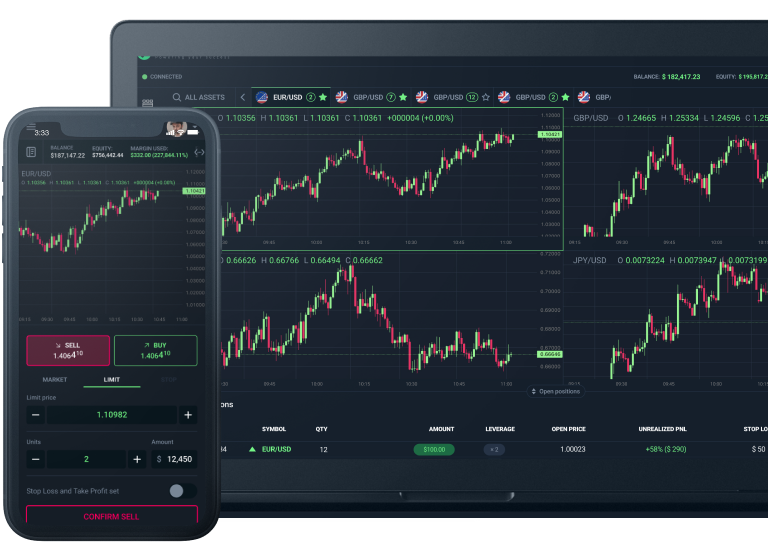

White-label investing platforms are software solutions that allow businesses to provide stock trading services to their customers under their own brand and identity without developing the technology and infrastructure in-house.

These platforms offer a comprehensive set of tools and features that enable businesses to provide a seamless trading experience for their clients, allowing them to focus on what they do best: onboarding clients, marketing, and providing value-added services such as research. You can eliminate the hassle of managing IT infrastructure, software development, and hosting by leveraging a white-label platform and instead focus on growing your customer base and improving their trading experience. You can learn more about the white-label trading platform on Soft-FX.com.

Impact of API Trading on White-Label Trading Platform

Increasing the Services’ Functionality

API in trading is a multifunctional solution that assists in increasing the efficiency of using various systems and services. An API solution, for example, can be used as part of a trading platform to extend its functionality by connecting third-party services to perform trading analytics and market analysis, study market sentiment, and collect statistical and historical data as part of trading a specific asset.

Linking systems

APIs enable complex connections between large systems, such as trading systems, and smaller solutions, such as widgets and plug-ins, in the form of indicators used to analyze financial asset price charts. The API key, on the other hand, can be used to connect different trading systems. Connecting various white-label crypto exchanges to a resource that provides automated trading provides a complete picture of the movement of funds in each account of any connected exchange.

Automation

API involves fewer individual tasks, which increases productivity and speeds up the setup process. You can publish content and information, as well as retrieve necessary data, with just a few clicks.

Conclusion

Trading APIs have a bright future, as they will revolutionize the trading industry and become common in white-label solutions. APIs provide a plethora of benefits to payment companies due to their ability to facilitate seamless data exchange and function integration.